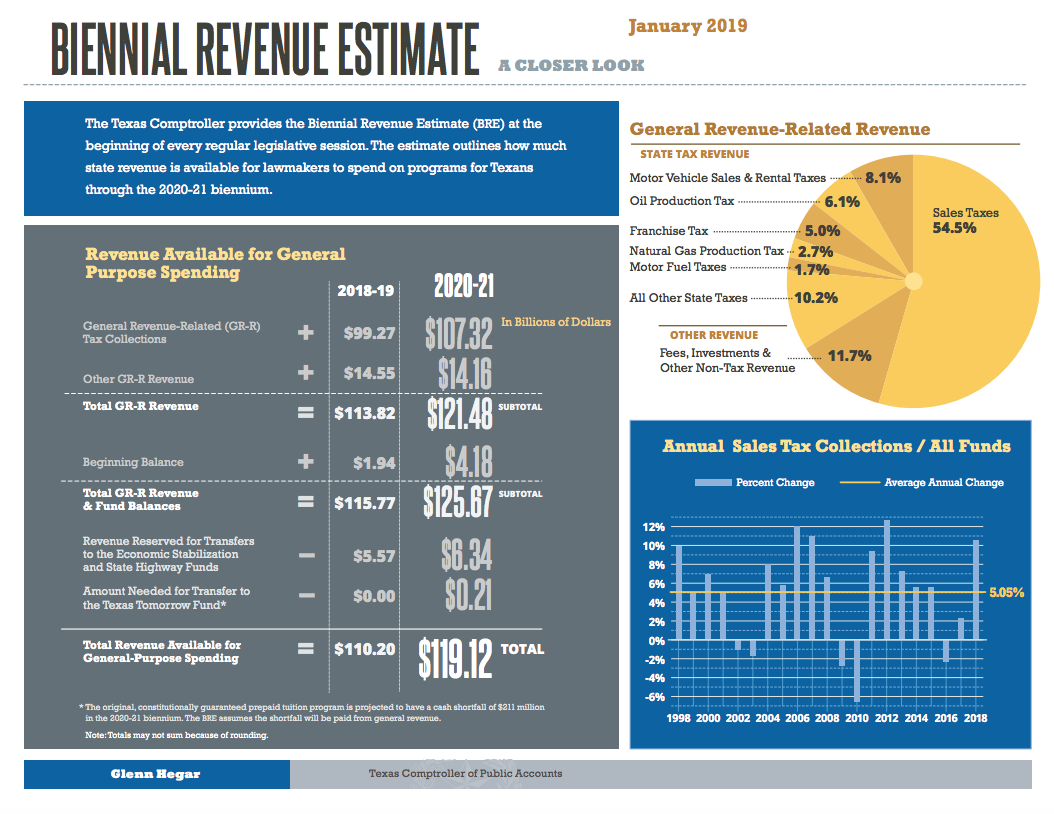

Texas Comptroller, Biennial Revenue Estimate (BRE). The Comptroller stated that there is a total of $119.12 billion available for general purpose spending which represents an increase of 8.1 percent. During the current biennium, economic growth in Texas accelerated, and revenue collections have consistently been stronger. Sales tax collections grew by more than 10% in FY2018. Continued growth is expected this year, though at a more modest rate— closer to historic averages. Recent economic conditions warrant a more cautious revenue outlook for the upcoming biennium. These include: the dropping price of oil, rising interest rates, trade policies can have a disproportionate impact on Texas, the global economy has shown signs of slowing, etc. Revenue projections are therefore based on continued but slowing expansion of the Texas economy. The Comptroller estimates $107.32 billion in GR-R tax collections in the upcoming biennium and $14.16 billion in non-tax GR, bringing the number to $121.48 billion in GR collections. There is more uncertainty in this estimate than previous estimates, but the Comptroller remains cautiously optimistic.

| From Previous Texas Insight Coverage. The 86th Legislature will have an estimated $119.12 billion available for general-purpose spending in the 2020-21 biennium, 8.1 percent more than the corresponding amount estimated for 2018-19. This figure represents the 2018-19 ending balance of $4.18 billion, plus 2020-21 tax revenue of $107.32 billion and 2020-21 non-tax receipts of $14.16 billion, less an estimated reserve of $6 .34 billion from oil and natural gas taxes for future transfer to the Economic Stabilization Fund (ESF) and the State Highway Fund (SHF), and less an estimated reserve of $211 million for transfer to the Texas Tomorrow Fund. |

There is a projected beginning balance in non-tax GR of $4.18 billion in unappropriated GR carried over from the current biennium. However, it is important to note that any GR appropriations from a supplemental appropriation will reduce this projected balance. For federal funds and constitutionally dedicated funds that can only be spent for designated purposes, we are projecting nearly $266 billion in All Funds revenues for the 2020-21 biennium. The State Highway Fund received $2.5 billion from sales tax collections in FY2018, though a portion of that amount was not deposited until September of 2018. Going forward, we expect sales tax collections to be sufficient to ensure that the entire $2.5 billion will be transferred in the same fiscal year in which it was collected. We no longer expect any portion of the transfers from this year’s collections to be deferred to FY2020.

***

The information contained in this publication is the property of Texas Insight. The views expressed in this publication are, unless otherwise stated, those of the author and not those of Texas Insight or its management.